What is the real growth in real estate? These days it appears that it’s impossible to paint a broad picture about Australia’s real estate market.

Marked difference for growth in real estate proves that each city appears to march to a very different drum, with figures for 2014 highlighting this discrepancy in the nationwide property landscape.

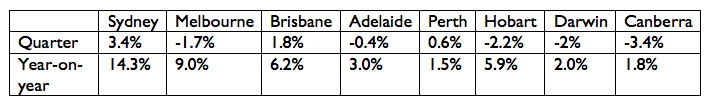

CoreLogic for 2014 show the difference in final quarter growth and year-on-year growth for 2014. While all cities experienced overall growth last year, not all of it was significant. It appears that Sydney has been growing at twice the pace of the rest of Australia, with Melbourne a not-so-close second in term of annual growth. Brisbane, missing in action for two years, found a late burst in 2014 while Perth, which rivaled Sydney and Melbourne in the growth stakes in 2013, slowed down markedly, recording the lowest capital growth of any city.

House price growth 2014:

RP Data CoreLogic House Growth November 2014

Low rates are a key factor driving Sydney’s booming market but you can also see the influence of low rates on up-graders across Australia, most acutely in Perth.

It’s interesting to note that investors are now responsible for 50% of all mortgages taken out for residential property in Australia, and it follows that where their share is highest, in Sydney with a record of 62%, the market is strongest.

Record low interest rates have made it possible for many people, especially those with equity in existing properties, to become investors for the first time. Notably, when interest rates rose five times in 2009-10 the market came to halt, but when rates fell to their lowest level since the 1960s, real estate recovered.

Low rates are a key factor driving Sydney’s booming market but you can also see the influence of low rates on up-graders across Australia, most acutely in Perth. The Perth market hasn’t had a great year, but for a city with fortunes so closely linked to mining’s plunging prices, you would expect to see house price falls of 5 to 10%. That hasn’t happened and the most telling reason why is low interest rates.

At One Agency we are always open for a conversation, so if you have anything to say in response or have any questions, please contact us.

T 1300 79 23 88

T +61 2 8039 2110 (International)

Back to top

Back to top Back to top

Back to top